http://realty.wistia.com/medias/ar313gm83w?embedType=async&videoWidth=800

buyer

Things to consider when …

Things to consider when buying a home.

- 4 REASONS TO BUY A HOME NOW!

- YOU NEED A PROFESSIONAL WHEN BUYING A HOME

- HOME PRICES OVER THE LAST YEAR

- BUYING A HOME? CONSIDER COST NOT JUST PRICE

- WHERE ARE MORTGAGE INTEREST RATES HEADED?

- SHOULD I PAY A MORTGAGE INTEREST RATE OVER 4%?

- WHAT DO YOU REALLY NEED TO QUALIFY FOR A MORTGAGE?

- WHAT YOU NEED TO KNOW ABOUT THE MORTGAGE PROCESS

- GETTING A MORTGAGE: WHY SO MUCH PAPERWORK?

- 217,726 REASONS TO BUY A HOME NOW

- THE REAL REASONS AMERICANS BUY A HOME

- RISING HOME PRICES & FAMILY WEALTH

- 5 REASONS TO HIRE A REAL ESTATE PROFESSIONAL

- REAL ESTATE AGAIN SEEN AS BEST INVESTMENT

- 4 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

- WHEN IS IT A GOOD TIME TO RENT? DEFINITELY NOT NOW!

- THE COST OF RENTING VS. BUYING [INFO-GRAPHIC]

- HARVARD: 5 FINANCIAL REASONS TO BUY A HOME

Call us 786.554.8063 or email us George@GeorgeAssal.com, WE are here to facilitate and help you during the process of buying, selling, or renting any real estate needs, which will result in reaching your financial goals quickly and with ease, visit our page www.GeorgeAssal.com

The Impact of Higher Interest Rates

Last week, an article in the Washington Post discussed a new ‘threat’ homebuyers will soon be facing: higher mortgage rates. The article revealed:

“The Mortgage Bankers Association expects that rates on 30-year loans could reach 4.8 percent by the end of next year, topping 5 percent in 2017. Rates haven’t been that high since the recession.”

How can this impact the housing market?

The article reported that recent analysis from Realtor.com found that –

“…as many as 7% of people who applied for a mortgage during the first half of the year would have had trouble qualifying if rates rose by half a percentage point.”

This doesn’t necessarily mean that those buyers negatively impacted by a rate increase would not purchase a home. However, it would mean that they would either need to come up with substantially more cash for a down payment or settle for a lesser priced home.

Below is a table showing how a jump in mortgage interest rates would impact the purchasing power of a prospective buyer on a $300,000 home.

In Conclusion

If you are considering a home purchase (either as a first time buyer or move-up buyer), purchasing sooner rather than later may make more sense from a pure financial outlook.

Tired of being a tenant? thinking of selling your home?, looking to upgrade? 1st time buyer(s)? buying your dream home? Call us 786.554.8063 or email us George@GeorgeAssal.com, WE are here to facilitate and help you during the process of buying, selling, or renting any real estate needs, which will result in reaching your financial goals quickly and with ease, visit our page www.GeorgeAssal.com

Applying For A Mortgage: Why So Much Paperwork?

We are often asked why there is so much paperwork mandated by the bank for a mortgage loan application when buying a home today. It seems that the bank needs to know everything about us and requires three separate sources to validate each and every entry on the application form.

Many buyers are being told by friends and family that the process was a hundred times easier when they bought their home ten to twenty years ago.

There are two very good reasons that the loan process is much more onerous on today’s buyer than perhaps any time in history.

The government has set new guidelines that now demand that the bank prove beyond any doubt that you are indeed capable of affording the mortgage. During the run-up in the housing market, many people ‘qualified’ for mortgages that they could never pay back. This led to millions of families losing their home. The government wants to make sure this can’t happen again

The banks don’t want to be in the real estate business. Over the last seven years, banks were forced to take on the responsibility of liquidating millions of foreclosures and also negotiating another million plus short sales. Just like the government, they don’t want more foreclosures. For that reason, they need to double (maybe even triple) check everything on the application.

However, there is some good news in the situation. The housing crash that mandated that banks be extremely strict on paperwork requirements also allowed you to get a mortgage interest rate probably at or below 4%.

The friends and family who bought homes ten or twenty ago experienced a simpler mortgage application process but also paid a higher interest rate (the average 30 year fixed rate mortgage was 8.12% in the 1990’s and 6.29% in the 2000’s). If you went to the bank and offered to pay 7% instead of <4%, they would probably bend over backwards to make the process much easier.

Bottom Line

Instead of concentrating on the additional paperwork required, let’s be thankful that we are able to buy a home at historically low rates.

Tired of renting and/or being a Tenant(s)? Thinking of selling your home?, looking to upgrade?, First Time buyer(s)? Buying your dream home this year? Call us, you know you can count on our help every step of the way while reaching your goal faster, easier and with a smile on your face. 📞786.554.8063 📧George@GeorgeAssal.com 💻 www.GeorgeAssal.com

There is NO Housing Bubble – Most Experts Agree.

There is no doubt that home prices in the vast majority of housing markets across the country are continuing to increase on a month over month basis. The following map (based on data from the latest CoreLogic pricing report) reveals the appreciation level by state:

These increases in value have caused some to be concerned about a new price bubble forming in residential real estate. Here are quotes from many of the most respected voices in the housing industry regarding the issue:

Nick Timiraos, reporter at the Wall Street Journal:

“Predictions of a new national home price bubble look unfounded for now, according to data.”

Michael Fratantoni, Chief Economist, the Mortgage Bankers Association:

“I don’t really see it as a bubble.”

Jack M. Guttentag, Professor of Finance Emeritus at the Wharton School of the University of Pennsylvania:

“My view is that we are a long way from another house price bubble.”

Rajeev Dhawan, Director of Economic Forecasting Center at J. Mack Robinson College of Business, Georgia State University:

“To have a bubble, you need to have construction rates higher than the perceived demand, which is what happened in 2003 to 2007. Right now, however, we have the reverse of that.”

Victor Calanog, Chief Economist, Reis:

“The housing market has yet to show evidence of systematic runaway asset price inflation characterized by home prices rising much faster than household income.”

David M. Blitzer, Chairman of the Index Committee for S&P Dow Jones:

“I would describe this as a rebound in home prices, not a bubble and not a reason to be fearful.”

Andrew Nelson, US Chief Economist, Colliers International:

“I don’t think there is a housing bubble.”

George Raitu, Director, Quantitative & Commercial Research, NAR:

“We do not consider the current market conditions to present a bubble.”

Christopher Thornberg, Founding Partner, Beacon Economics:

“The housing market is far from overheated.”

So why have prices been increasing?

Today, there is a gap between supply (number of houses on the market) and demand (the number of buyers looking for a new home). In any market, this would cause values to increase. Here are some experts’ comments on this issue:

Jonathan Smoke, realtor.com Chief Economist:

“So does that mean we’re in a bubble? Nope, that’s just what happens when demand increases faster than supply.”

Robert Bach, Director of Research – Americas, Newmark Grubb Knight Frank:

“I don’t think the housing market is overheated based on demand and supply fundamentals.”

Mark Dotzour, Chief Economist, Real Estate Center, Texas A&M University:

“We are not in a housing bubble. We are in a situation where demand for houses is much higher than supply.”

Calvin Schnure, SVP of Research & Economic Analysis, NAREIT:

“Given all the demand and little supply the residential market is FAR from overheated.”

Bottom Line

Currently, there is an imbalance between supply and demand for housing. This has created a natural increase in values not a bubble in prices. Don’t let the imbalance bubble to get you, CALL us today 786.554.8063 or email us at George@GeorgeAssal.com, you know you can count on our help every step of the way while reaching your goal faster, easier and with a smile on your face.

Where Are Mortgage Rates Headed? This Fall? Next Year?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be.

That is why it is important to look at where rates are headed when deciding to buy now or wait until next year.

Below is a chart created using Freddie Mac’s July 2015 U.S. Economic & Housing Marketing Outlook. As you can see interest rates are projected to increase steadily over the course of the next 12 months.

How Will This Impact Your Mortgage Payment?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

Dr. Frank Nothaft, the SVP & Chief Economist for CoreLogic, had this to say in their latest Market Pulse:

“If you are thinking of buying a home and have the financial means to do so, this could be a good time to take a look at the neighborhoods you are interested in. We expect home prices in our national index to be up about 4.3% in the next 12 months, and mortgage rates are also likely to increase over the next year.”

If both the predictions of home price and interest rate increases become reality, families would wind up paying considerably more for their next home.

Bottom Line

Even a small increase in interest rate can impact your family’s wealth. Meet with us to evaluate your ability to purchase your dream home. Remember We at the ASSAL team want to make sure you get the lowest mortgage rate possible, while reaching your goal faster, easier and with a smile on your face! Give us a call today at 786.554.8063 or send us an email at george@georgeassal.com– you can count on our help every step of the way.

Things to Consider When Buying a Home (Summer Guide 2015)

Thank you to those that have e-mailed us with questions and concerns about things to consider when buying a home, since we care about you, the ASSAL team has put together a guide called “Buying a Home – Buyer Guide”.

As we said it before, Why would you make one of your most important financial decisions of your life without hiring a Real Estate Professional?. The ASSAL team is here to help you, call us, We want to make sure you have all answers to those questions and/or concerns and most important to help you overcome your fears and reach your goal faster, (the goal is for you to buy your dream home) easier and with a smile on your face! Give us a call today at 786.554.8063 or send us an email at george@georgeassal.com– you can count on our help every step of the way.

What is a Housing Bubble? Is One Forming?

The recent talk of Greece and its financial challenges has some questioning whether the U.S. could also return to the crisis we experienced in 2008. Some are looking at the rise in real estate values and wondering whether we are in the middle of another housing price bubble.

What actually is a price bubble?

Here is the definition according to Jack M. Guttentag, Professor of Finance Emeritus at the Wharton School of the University of Pennsylvania:

“A price bubble is a rise in price based on the expectation that the price will rise. Sooner or later something happens to erode confidence in continued price increases, at which point the bubble bursts and prices drop. What makes it a price bubble is that the cause of the price increase is an expectation that the price will increase, which sooner or later must reverse itself.”

Does Professor Guttentag believe we are in another housing bubble?

In a recent article, he explained:

“My view is that we are a long way from another house price bubble. Home buyers, lenders, investors and regulators now understand that a nationwide decline in house prices is possible — because we recently lived through one.”

What are home prices doing?

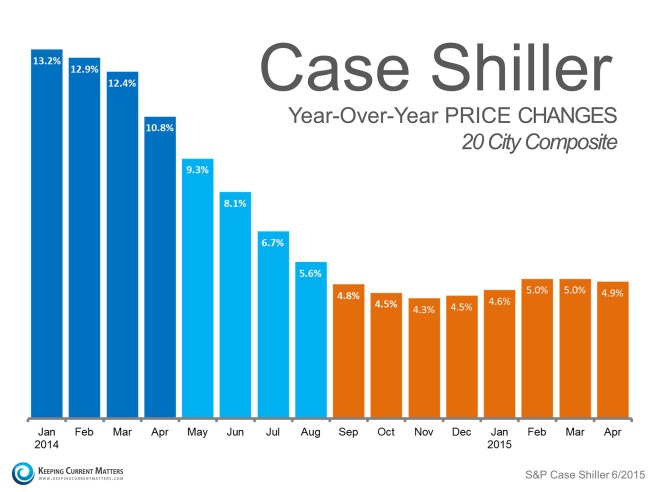

Though home values are continuing to appreciate, the acceleration of the increases has slowed to year-over-year numbers which reflect a healthy housing market. Here is a chart showing year-over-year appreciation since January of last year:

We can see that appreciation rates have dropped from double digit numbers to more normal rates of 5% or lower.

Bottom Line

We think Nick Timiraos of the Wall Street Journal put it best in a recent tweet:

“Predictions of a new national home price bubble look unfounded for now, according to data.”

Interested in selling your home or looking to buy one, give us a call today at 786.554.8063 or send us an email at george@georgeassal.com. We will look forward to hearing from you!

For Sellers – Two Graphs That Scream List Your House Today

The spring and summer months have always been known as a very popular time for homebuyers to start the search for their dream home. This year is no different!

We all learned in school that when selling anything, you will get the most money if the demand for that item is high and the inventory of that item is low. It is the well-known Theory of Supply & Demand.

If you are thinking of selling your home, here are two graphs that strongly suggest that the time is now. Here is why…

DEMAND

According to research at the National Association of Realtors (NAR), buyer activity this year has far outpaced the same months in 2014. Purchasers who are ready, willing and able to buy are in the market at great numbers.

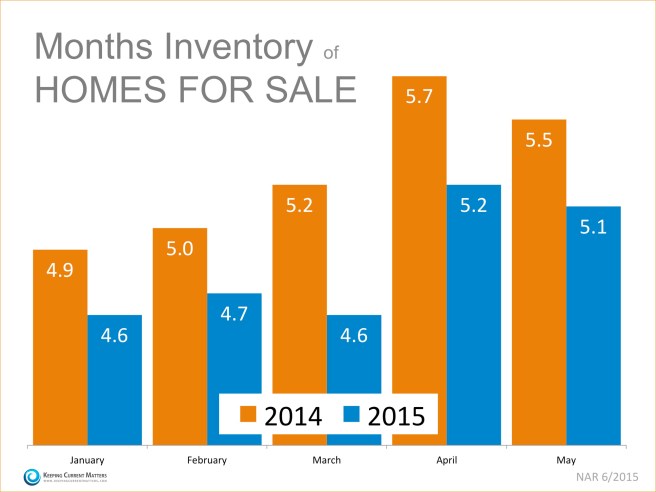

SUPPLY

The most recent Existing Home Sales Report from NAR revealed that the current supply of housing inventory is at a 5.1 month supply, which remains below the 6-months necessary for a normal market.

Bottom Line

Listing your house for sale when demand is high and supply is low will guarantee the offers made will truly reflect the true value of your property. Interested in selling your home or looking to buy one, give us a call today at 786.554.8063 or send us an email at george@georgeassal.com. We will look forward to hearing from you!

Park Grove in Coconut Grove.

Park Grove in Coconut Grove.

Most ambitious architecture/project to date

The New Park Grove Condo Project is selling quickly; this luxury condo project is located in Coconut Grove more specific in the middle of a newly developed waterfront park. The condo project has 3 towers with great investment values.

Designed by OMA and rem KOOLHAAS, the striking towers of PARK GROVE set a new architectural standard in the quiet seaside enclave of Coconut Grove.

Park Grove Residences will blow everyone expectations with their high-end waterfront project. With amenities that will take you to the next level and to better your experience, The Park grove Condo offers pools, fitness, yoga, a private chef, yes a private chef and much more.

As the first Luxury Condo in Coconut Grove to be built after Grove at Grand Bay, makes this project most ambitious architecture/project to date

Contact me For more info about Park Grove and any other projects / new constructions in Miami or South Florida ![]()