Like the guy in the video says, the two do not really compare at all. The one advantage of renting is being generally free of most maintenance responsibilities. But by renting, you lose the chance to build equity take advantage of tax benefits and protect yourself against rent increases.Also, you may be at the mercy of the landlord for housing. Owning a home has many benefits. When you make a mortgage payment, you are building equity increasing YOUR net worth. Owning a home also qualifies you for tax breaks that assist you in dealing with your new financial responsibilities like insurance, real estate taxes, and upkeep which can be substantial. But given the freedom, stability, and security of owning your own home they are worth it.

Selling Real Estate

Calculating Your Asking Price

Sales Dropped last month …

On December 22nd 2015, the National Association of Realtors (NAR) released their latest Existing Home Sales Report which covered sales in November. The report revealed that sales:

“…fell 10.5 percent to a seasonally adjusted annual rate of 4.76 million in November (lowest since April 2014 at 4.75 million)…”

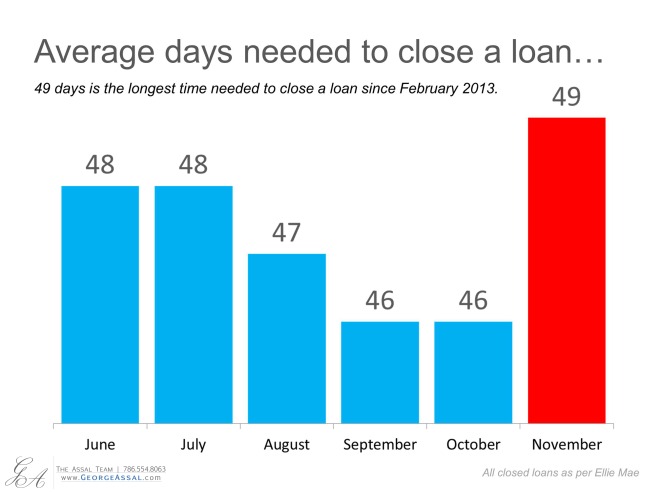

That revelation gave birth to a series of industry articles, some of which quoted pundits questioning whether the housing market was slowing. In actuality, there is one rather simple explanation to much of the falloff in sales last month. It is likely the implementation of the “Know Before You Owe” mortgage rule, commonly known as the TILA-RESPA Integrated Disclosure (TRID) rule, which went into effect on October 3. These regulations caused house closings to be delayed by an extra three days in November as shown in the graph below.

Three days might sound like a minimal difference. However, since there are only approximately 20 days in a month that a closing would normally take place (Mondays through Fridays), losing three days constitutes well over 10% of all closings. These sales are not lost. They are just moved into the next month’s numbers. In a DS News article on the subject also posted on December 22nd, Auction.com EVP Rick Sharga explained:

“The most likely cause for the weak sales numbers is a delay in processing loans due to the new TRID mortgage requirements imposed by the CFPB. This is the biggest change in mortgage document processing in many years, and there have been numerous reports within the industry of problems implementing the process and the new documentation that comes with it.”

So how is the housing market actually doing?

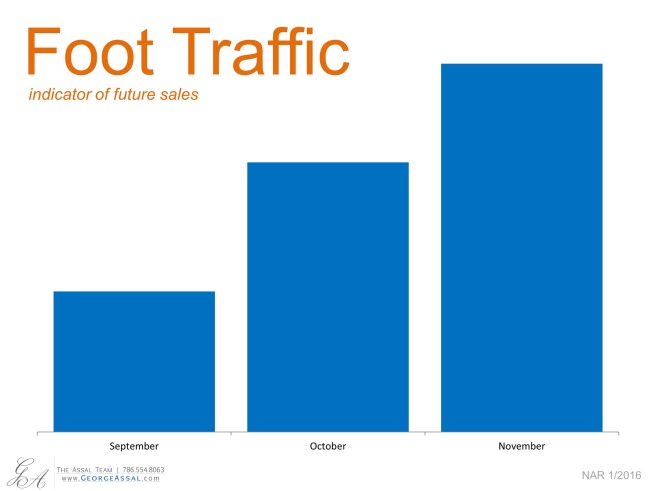

A better way to look at how well the housing market is doing is to look at the Foot Traffic Report from NAR which quantifies the number of prospective buyers that are actively looking for a home at the current time:

We can see immediately that demand to buy single family homes is increasing over the last few months – not decreasing.

Bottom Line

No matter what last month’s sales numbers show, the housing market is still doing well as demand remains strong.

Call 786.554.8063 or email us George@GeorgeAssal.com, WE are here to facilitate and help you during the process of buying, selling, or renting any real estate needs, which will result in reaching your financial goals quickly and with ease, visit our page www.GeorgeAssal.com .

Selling your House?

Here is what you should consider when selling your house:

- 5 REASONS TO SELL NOW

- HOW TO GET THE MOST MONEY FROM THE SALE OF YOUR HOME

- DON’T WAIT! MOVE UP TO THE HOUSE YOU ALWAYS WANTED

- THE IMPORTANCE OF USING AN AGENT WHEN SELLING YOUR HOME

- 5 DEMANDS TO MAKE ON YOUR REAL ESTATE AGENT

- HOME PRICES OVER THE LAST YEAR

- THE IMPACT OF RISING PRICES ON HOME APPRAISALS

- 5 REASONS YOU SHOULDN’T FOR SALE BY OWNER (FSBO)

- HOME EQUITY: YOU MAY HAVE MORE THAN YOU THINK?

- BABY BOOMERS FINDING FREEDOM IN RETIREMENT

- WHERE ARE MORTGAGE INTEREST RATES HEADED?

- HOW WILL MORTGAGE RATE HIKES IMPACT HOME SALES?

- TWO THINGS YOU DON’T NEED TO HEAR FROM YOUR LISTING AGENT (US)

- FSBO’s MUST BE READY TO NEGOTIATE

- FANNIE MAE AGREES: HIRE A PRO (US) TO SELL

Read full Seller(s) guide here

Call us 786.554.8063 or email us George@GeorgeAssal.com, WE are here to facilitate and help you during the process of buying, selling, or renting any real estate needs, which will result in reaching your financial goals quickly and with ease, visit our page www.GeorgeAssal.com

Selling Your Home? Price It Right From the Start!

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their customers happy. However, we realized that telling the homeowner the truth is more important than getting the seller(s) to like us.

There is no “later.”

Sellers sometimes think, “If the home doesn’t sell for this price, I can always lower it later.” However, research proves that homes that experience a listing price reduction sit on the market longer, ultimately selling for less than similar homes.

John Knight, recipient of the University Distinguished Faculty Award from the Eberhardt School of Business at the University of the Pacific, actually did research on the cost (in both time and money) to a seller who priced high at the beginning and then lowered the their price. In his article, Listing Price, Time on Market and Ultimate Selling Price published in Real Estate Economics revealed:

“Homes that underwent a price revision sold for less, and the greater the revision, the lower the selling price. Also, the longer the home remains on the market, the lower its ultimate selling price.”

Additionally, the “I’ll lower the price later” approach can paint a negative image in buyers’ minds. Each time a price reduction occurs, buyers can naturally think, “Something must be wrong with that house.” Then when a buyer does make an offer, they low-ball the price because they see the seller as “highly motivated.” Pricing it right from the start eliminates these challenges.

Don’t build “negotiation room” into the price.

Many sellers say that they want to price their home high in order to have “negotiation room.” But, what this actually does is lower the number of potential buyers that see the house. And we know that limiting demand like this will negatively impact the sales price of the house.

Not sure about this? Think of it this way: when a buyer is looking for a home online (as they are doing more and more often), they put in their desired price range. If seller is looking to sell their house for $400,000, but lists it at $425,000 to build in “negotiation room,” any potential buyers that search in the $350k-$400k range won’t even know your listing is available, let alone come see it!

One great way to see this is with the chart below. The higher you price your home over its market value, the less potential buyers will actually see your home when searching.

A better strategy would be to price it properly from the beginning and bring in multiple offers. This forces these buyers to compete against each other for the “right” to purchase your house.

Look at it this way: if you only receive one offer, you are set up in an adversarial position against the prospective buyer. If, however, you have multiple offers, you have two or more buyers fighting to please you. Which will result in a better selling situation?

The Price is Right

Great pricing comes down to truly understanding the real estate dynamics in your neighborhood. Our team will take the time to simply and effectively explain what is happening in the housing market and how it applies to your home.

Our team will tell you what you need to know rather than what you want to hear. This will put you in the best possible position.

Thinking of selling your home and not sure how to price it right? Call us, We at the ASSAL team want to make sure you price your home right while reaching your goal faster, easier and with a smile on your face! Give us a call today at 786.554.8063 or send us an email at george@georgeassal.com– you can count on our help every step of the way.

Are Home Values REALLY at Record Levels?

On July 12th, we posted an article called “What is a Housing Bubble? Is One Forming?”, last week, the National Association of Realtors (NAR) released their Existing Home Sales Report. The report announced that the median existing-home price in June was $236,400. That value surpasses the peak median sales price set in July 2006 ($230,400). This revelation created many headlines exclaiming that home prices had hit a “new record”:

Wall Street Journal: Existing-Home Prices Hit Record

USA Today: Existing home sales surge, prices hit record

Though the headlines are accurate, we want to take a closer look at the story. We do not want people to believe that this information is evidence that a new “price bubble” is forming in housing.

NAR reports the median home price. That means that 50% of the homes sold above that number and 50% sold below that number. With fewer distressed properties (lower valued) now selling, the median price will rise. The median value does not reflect that each individual property is increasing in value.

Below are the comments from Bill McBride, the author of the esteemed economic blog Calculated Risk. McBride talks about the challenges with using the median price and also explains that in “real” prices (taking into consideration inflation) we are nowhere close to a record.

“In general I’d ignore the median sales price because it is impacted by the mix of homes sold (more useful are the repeat sales indexes like Case-Shiller or CoreLogic). NAR reported the median sales price was $236,400 in June, above the median peak of $230,400 in July 2006. That is 9 years ago, so in real terms, median prices are close to 20% below the previous peak. Not close.”

Earlier this week, the Wall Street Journal covered this issue in detail. In this story, Nick Timiraos explained that this rise in median prices is nothing to be concerned about:

“Does this mean we have another problem on our hands? Not really…There may be other reasons to worry about housing affordability by comparing prices with incomes or prices with rents for a given market. But crude comparisons of nominal home prices with their 2006 and 2007 levels shouldn’t be used to make cavalier claims about a new bubble.”

Bottom Line

Home values are appreciating. However, they are not increasing at a rate that we should have fears of a new housing bubble around the corner. Fear of loosing the opportunity of buying or selling your home? Call us, We at the ASSAL team want to make sure you overcome your fears and reach your goal faster, easier and with a smile on your face! Give us a call today at 786.554.8063 or send us an email at george@georgeassal.com– you can count on our help every step of the way.